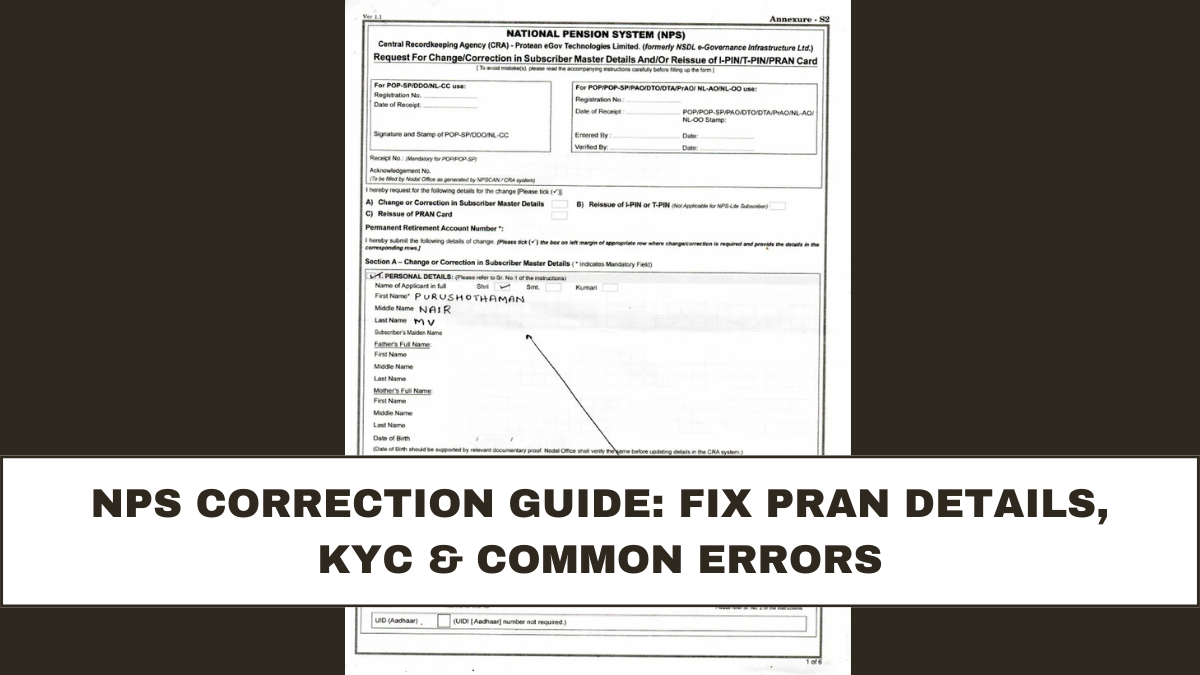

Managing your NPS account correction is crucial for seamless National Pension System operations. Many subscribers face issues like name mismatch, date of birth errors, or outdated KYC details, which can create complications during withdrawals, contributions, or government benefits. Understanding how to make corrections early helps avoid delays and last-minute panic near the deadline.

This guide explains how to fix NPS PRAN details, update KYC, and correct common errors efficiently.

What Is NPS PRAN and Why Accuracy Matters

PRAN (Permanent Retirement Account Number) is a unique identifier for every NPS subscriber. Accuracy in PRAN details is essential because:

• It links your contributions correctly

• Ensures tax benefits are credited properly

• Helps with withdrawals at retirement

• Prevents processing errors in government or corporate records

If PRAN details contain errors, you may face problems during contribution matching or pension settlement.

Common NPS Account Issues Requiring Correction

Some frequent reasons people need nps account correction include:

-

Name mismatch between PRAN and Aadhaar/PAN

-

Incorrect date of birth

-

Wrong gender or category information

-

Bank account or IFSC mismatch

-

KYC not updated or expired

These errors can cause delays in contributions, tax credits, or pension processing.

How to Correct Name or Date of Birth Errors in PRAN

If your PRAN shows incorrect personal details:

• Log in to the NPS subscriber portal using your PRAN

• Navigate to “Update Personal Details” or “Modify PRAN”

• Submit the correct name/DOB with supporting documents such as:

-

Aadhaar card

-

PAN card

-

Passport (if needed)

• Verify and submit the request

• Wait for confirmation from the central record-keeping agency (CRA)

Correcting your PRAN details ensures your NPS account correction is fully recognized in government records.

Updating KYC for NPS

KYC is mandatory for NPS contributions and withdrawals. If KYC is outdated:

• Log in to your NPS account

• Go to “Update KYC” or “KYC Modification”

• Provide updated documents:

-

Aadhaar

-

PAN

-

Bank account details

• Submit for verification

Once KYC is updated, your account can receive contributions smoothly, and withdrawals will not face delays.

Why Timely NPS Account Corrections Matter

Delaying NPS account correction can lead to:

• Contributions being rejected

• Tax benefits not being credited

• Issues during partial withdrawals or pension settlement

• Delays in government matching contributions

• Problems with online account access

Correcting your PRAN details and KYC well before the deadline ensures smooth account management.

Step-by-Step Checklist for NPS Corrections

To fix nps account correction efficiently, follow this checklist:

-

Verify PRAN details and personal information

-

Check KYC status in the subscriber portal

-

Gather supporting documents (Aadhaar, PAN, bank proof)

-

Submit changes online via the NPS portal

-

Track correction status regularly

-

Confirm updated details in CRA notifications

Following this checklist avoids repeated corrections and ensures contributions are processed on time.

How to Track NPS Correction Status

After submitting corrections:

• Log in to the NPS CRA portal

• Check “Update Request Status”

• You will see whether your request is approved, rejected, or pending verification

• Keep digital or physical acknowledgment for records

Tracking helps you stay informed and prevents last-minute errors.

Common Mistakes to Avoid While Correcting NPS Account

Many subscribers face delays due to avoidable errors:

• Uploading unclear documents

• Mismatched names across Aadhaar, PAN, and PRAN

• Ignoring bank account KYC updates

• Waiting until the last day to correct errors

• Not tracking the correction status

Avoiding these mistakes ensures faster processing.

Benefits of Accurate NPS Account Information

Keeping your NPS account accurate provides:

• Seamless contributions

• Smooth withdrawals and pension settlement

• Correct tax benefit claims

• Avoidance of administrative errors

• Peace of mind regarding retirement planning

Accurate PRAN and KYC details also reduce the risk of rejection or unnecessary follow-ups.

Final Thoughts

An NPS account correction is a simple yet important step for every subscriber. Ensuring PRAN, KYC, and personal details are correct helps prevent delays in contributions, tax benefits, and pension settlements. By following the checklist and updating details before deadlines, NPS subscribers can manage their accounts efficiently and securely.

FAQs

What is NPS PRAN correction?

It is the process of updating personal details like name, date of birth, or gender in your NPS account.

How can I update KYC in NPS?

You can update KYC online through the NPS subscriber portal by submitting Aadhaar, PAN, and bank proof.

Why is NPS account correction important?

Correct details ensure smooth contributions, withdrawals, and proper credit of tax benefits.

How long does it take to reflect corrections?

Typically, updates take a few working days after verification by the CRA.

Can I submit corrections after the deadline?

It is advisable to correct details before deadlines to avoid rejected contributions or delays in pension processing.

Click here to know more.