On paper, Indian households look financially cautious. Savings rates are up, discretionary spending is down, and big purchases are being postponed. But beneath these numbers sits a deeper issue: personal finance anxiety India is reshaping everyday decisions. People aren’t cutting back because they want to—they’re holding back because they’re unsure what tomorrow costs.

In 2026, money stress isn’t about poverty alone. It’s about uncertainty, rising fixed expenses, and the feeling that effort no longer guarantees stability.

Why Personal Finance Anxiety in India Is Rising

The anxiety isn’t irrational—it’s structural.

Key drivers include: • Higher food and fuel volatility • Rising rents in urban centers • Education and healthcare costs climbing faster than income • EMIs consuming larger salary shares

These pressures compound, creating personal finance anxiety India across income levels.

Saving More While Feeling Poorer

A paradox defines 2026.

What people report: • More money set aside monthly • Less confidence to spend it • Fear of emergencies wiping savings • Reluctance to enjoy discretionary purchases

Saving has become defensive, not aspirational—a hallmark of personal finance anxiety India.

Inflation Anxiety Hits Daily Decisions

Inflation isn’t just a statistic—it’s a daily reminder.

Effects on behavior: • Smaller grocery baskets • Delayed appliance upgrades • Switching brands frequently • Constant price comparison

When prices feel unpredictable, spending feels risky.

EMIs Are the Silent Stress Multiplier

Loans once signaled progress. Now they signal pressure.

Common realities: • Housing EMIs stretching for decades • Car and personal loans overlapping • Limited room for income shocks • Fear of job disruption

For many families, personal finance anxiety India is really EMI anxiety.

Why Middle-Class Anxiety Is the Sharpest

The middle class sits in the squeeze zone.

Challenges include: • Income growth lagging expenses • Ineligibility for subsidies • Lifestyle expectations staying high • Rising comparison pressure

They earn “enough” to be excluded—but not enough to feel secure.

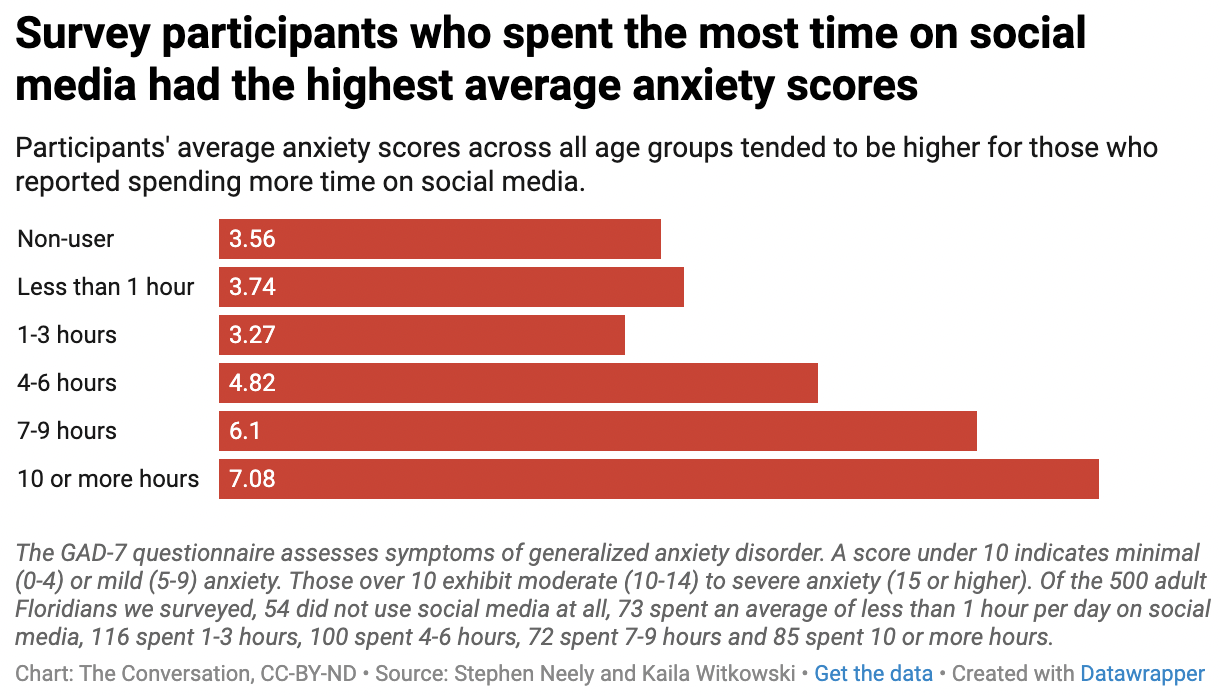

Social Media Is Making Money Stress Worse

Digital comparison amplifies personal finance anxiety India.

Why: • Curated success looks universal • Debt behind lifestyles stays hidden • Financial reality feels like personal failure

People compare highlights to their own balance sheets—and lose.

Why Big Purchases Are Being Delayed

Hesitation has replaced confidence.

Delayed decisions include: • Homes and upgrades • Cars and two-wheelers • International travel • Long-term commitments

People ask not “Can I afford this?” but “What if something goes wrong?”

How Indians Are Coping With Money Anxiety

Coping mechanisms are pragmatic—but emotionally heavy.

Common responses: • Strict budgeting and tracking • Emergency fund obsession • Conservative investments • Reduced lifestyle risks

These steps help—but don’t remove the underlying uncertainty fueling personal finance anxiety India.

Why This Anxiety Isn’t About Financial Illiteracy

Knowledge hasn’t removed fear.

Even financially aware individuals feel anxious because: • Macro risks feel uncontrollable • Job markets feel fragile • Safety nets feel thin

The issue isn’t ignorance—it’s unpredictability.

What Restores Confidence Over Time

Confidence grows from structure, not shortcuts.

What helps: • Clear emergency buffers • Realistic lifestyle calibration • Income diversification • Long-term planning over panic saving

Reducing personal finance anxiety India is about control—not perfection.

Conclusion

Personal finance anxiety India in 2026 reflects a deeper shift: people don’t trust stability anymore. They’re not reckless—they’re cautious to the point of paralysis. Saving more doesn’t feel safe when costs feel unpredictable and commitments feel heavy.

The path forward isn’t extreme frugality. It’s realistic planning, emotional honesty about money, and systems that reduce fear instead of amplifying it.

FAQs

Why are Indians feeling anxious about money despite saving more?

Because rising fixed costs and uncertainty make savings feel fragile.

Is inflation the main cause of this anxiety?

It’s a major factor, but EMIs and job insecurity amplify it.

Which group feels this anxiety the most?

Urban middle-class households with high fixed expenses.

Does financial literacy solve money anxiety?

Not entirely. Structural uncertainty matters more than knowledge.

What helps reduce personal finance anxiety long term?

Emergency buffers, realistic planning, and reducing fixed-cost pressure.

Click here to know more.