In 2026, fixed deposits in India are no longer treated as boring parking instruments. They have quietly re-entered the emotional center of middle-class financial planning. Volatile equity markets, uncertain global cues, and inconsistent mutual fund returns have pushed conservative and semi-aggressive investors back toward one thing they deeply trust: predictable income.

That is why HDFC FD interest rates in Jan 2026 matter far more than they did a few years ago.

HDFC Bank is not just another large bank. It is the psychological benchmark of safety for millions of Indian savers. When HDFC tweaks its FD rates, it reshapes behavior across the entire deposit market.

So this is not just a rate chart article. This is a decision guide for how to actually use HDFC fixed deposits intelligently in 2026.

Why HDFC FD Rates in 2026 Are Emotionally Important for Savers

Indian savers in 2026 are going through a mindset shift.

They are no longer obsessed only with maximum returns.

They are obsessed with:

-

Capital safety

-

Stable monthly or quarterly income

-

Liquidity without panic selling

-

Protection against market drawdowns

This is exactly where HDFC fixed deposits fit emotionally.

People are not using FDs to get rich.

They are using them to sleep better at night.

And in 2026, that psychological value is rising sharply.

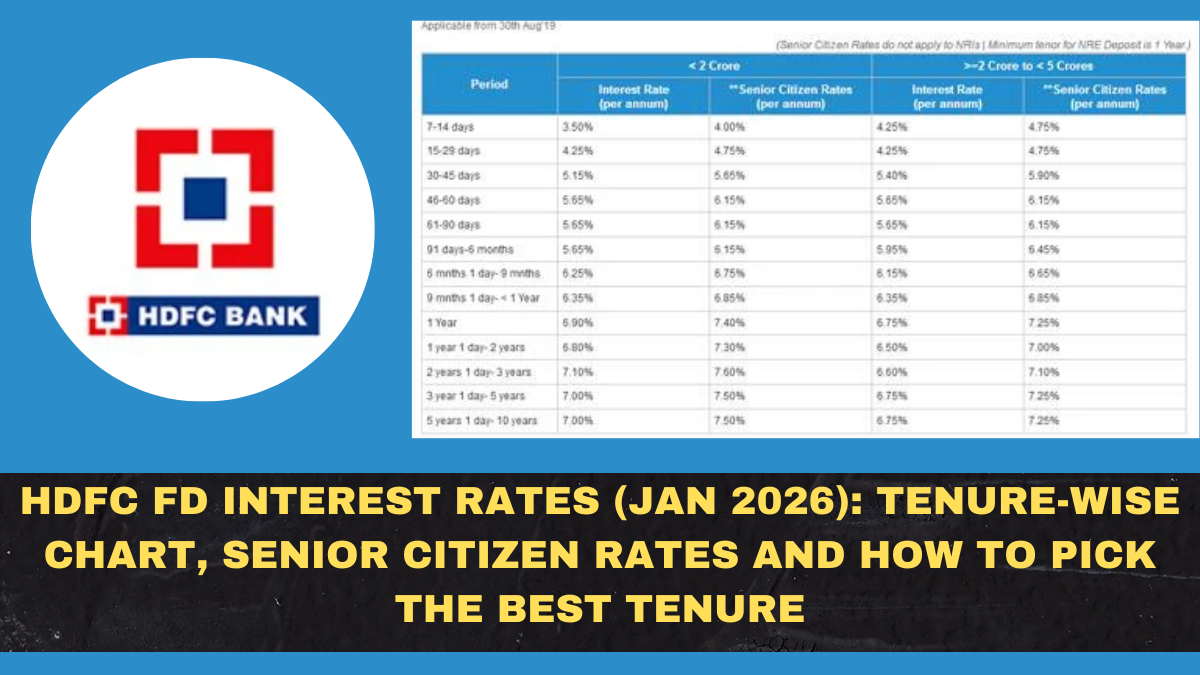

HDFC FD Interest Rates Jan 2026: Tenure-Wise Snapshot

Here is a simplified view of how HDFC FD interest rates in Jan 2026 are structured across major tenures.

| Tenure Range | Regular Citizen Rate (Approx) | Senior Citizen Rate (Approx) |

|---|---|---|

| 7–45 days | Lower slab | Lower slab + extra |

| 46–179 days | Moderate slab | Moderate + extra |

| 180 days – < 1 year | Mid slab | Mid + extra |

| 1 year – < 2 years | Higher slab | Higher + extra |

| 2 years – < 3 years | Peak slab | Peak + extra |

| 3 years – 5 years | Slightly lower than peak | Slightly lower + extra |

| Above 5 years | Stable slab | Stable + extra |

The exact percentages vary slightly by product type and deposit size, but the structure reveals something important.

HDFC is clearly rewarding medium-term deposits more than ultra-short or ultra-long ones.

Where HDFC Is Offering the Best Value in 2026

The real opportunity in HDFC FDs in 2026 sits in a narrow tenure band.

Historically and structurally, HDFC tends to offer its best rates in:

-

The 15-month to 30-month range

-

The 2-year to 3-year range

Why this band matters:

-

Rates are near peak

-

Lock-in is not extreme

-

Reinvestment risk is controlled

-

Liquidity sacrifice is reasonable

This is the sweet spot for most conservative investors.

Senior Citizen FD Rates: The Hidden Advantage

Senior citizens remain the biggest winners in the FD ecosystem in 2026.

HDFC offers an additional interest rate premium for senior citizens across almost all tenures.

This premium creates a structural advantage.

In practical terms:

-

Senior citizens earn meaningfully more than regular depositors

-

Monthly interest income becomes more attractive

-

Capital safety plus income becomes a powerful combination

For retirees living off interest income, this premium is not cosmetic.

It materially changes monthly cash flow.

How to Actually Choose the Best FD Tenure in 2026

This is where most people make irrational decisions.

They blindly choose the longest tenure because “rates look higher.”

That is a mistake.

Here is the rational framework for picking HDFC FD tenure in 2026.

1. If You Want Maximum Interest Rate

Choose the tenure band where HDFC is offering its peak slab.

Usually:

-

Around 18–30 months

This locks in high rates without excessive commitment.

2. If You Want Liquidity Safety

Choose:

-

6–12 months

You sacrifice some interest but retain flexibility.

This makes sense if:

-

You expect rate hikes

-

You may need money soon

-

You are parking surplus funds temporarily

3. If You Want Stable Long-Term Income

Choose:

-

3–5 years

This works best for retirees and conservative investors who value predictable income over maximum returns.

4. If You Are Building a Ladder Strategy

Split your FD into multiple tenures:

-

1 year

-

2 years

-

3 years

This:

-

Reduces reinvestment risk

-

Smooths interest rate volatility

-

Improves liquidity planning

This strategy is vastly superior to one big long-term FD.

Taxation Reality: The Part Everyone Ignores

This is where emotional disappointment often happens.

FD interest is fully taxable.

It is added to your income slab.

That means:

-

A 7.5% FD is not really 7.5% for you

-

A 30% tax slab investor effectively earns ~5.25% post-tax

This reality matters deeply in 2026.

Because post-tax returns, not headline rates, determine real wealth protection.

FD vs Other Safe Options in 2026

Compared to alternatives:

-

Post Office schemes → Higher lock-in

-

Debt mutual funds → Market risk

-

Corporate FDs → Higher risk

-

Small finance banks → Higher returns, lower trust

HDFC FDs win on:

-

Brand trust

-

Liquidity

-

Safety perception

-

Service reliability

That emotional trust premium is real.

Should You Lock Long-Term HDFC FDs in 2026?

This depends on interest rate psychology.

If you believe rates will fall in the next 1–2 years:

-

Locking longer tenure now makes sense.

If you believe rates will rise:

-

Stay in shorter tenures or ladder strategy.

In 2026, rate direction uncertainty is still high.

Which makes laddering the most rational approach.

Who Should Definitely Consider HDFC FDs in 2026

HDFC fixed deposits make strong sense for:

-

Senior citizens

-

Conservative investors

-

People nearing retirement

-

Families building emergency funds

-

People parking large lump sums

They are not ideal for:

-

High-risk investors

-

Long-term wealth builders

-

People in low tax slabs seeking growth

The Psychological Truth About Fixed Deposits in 2026

FDs are not exciting.

They are not trendy.

They are not wealth-multipliers.

But in 2026, they are emotionally stabilizing.

They give:

-

Predictable income

-

Capital certainty

-

Mental peace

In a world full of financial noise, that stability has value.

Conclusion: How to Use HDFC FD Rates Intelligently in Jan 2026

HDFC FD interest rates in Jan 2026 are not extraordinary.

But they are structurally useful.

They offer:

-

Safety

-

Predictability

-

Reasonable returns

-

Senior citizen advantage

The real intelligence is not in chasing the highest rate.

It is in choosing the right tenure for your life situation.

If you do that correctly, HDFC FDs remain one of the smartest low-stress financial tools available to Indian savers in 2026.

FAQs

What are HDFC FD interest rates in Jan 2026?

HDFC FD rates vary by tenure and deposit size, with peak rates usually in the 18–30 month range.

Do senior citizens get higher FD rates at HDFC?

Yes. Senior citizens receive an additional interest rate premium across most tenures.

Which FD tenure gives the highest return in HDFC?

Typically, the 18–30 month tenure band offers the highest rates.

Is FD interest taxable in India?

Yes. FD interest is fully taxable as per your income slab.

Should I lock a long-term FD in 2026?

Only if you believe interest rates will fall. Otherwise, laddering is safer.

Are HDFC fixed deposits safe in 2026?

Yes. HDFC Bank remains one of India’s most trusted and stable banks.